Contents:

The bullish and bearish candlestick patterns forex Piercing Candlestick Pattern is a technical analysis tool used in forex trading to identify potential trend reversals. This pattern consists of two candlesticks, the first being a long green bullish candle and the second a long red bearish candle. The bearish candle opens above the previous day’s close, but then closes below the midpoint of the previous day’s bullish candle, thus piercing through it. Forex traders often use this pattern as a signal to sell, or to take short positions in anticipation of a price drop. In conclusion, the Bearish Piercing Candlestick Pattern is a popular technical analysis tool used in forex trading to identify potential trend reversals.

First, a big bearish candlestick will form, showing the dominance of sellers. Then three small bullish candlesticks will form within the range of the previous candlestick. These three small bullish candlesticks indicate retracement upward.

What are the top 4 bearish candlestick patterns?

Candlestick patterns are building blocks of technical analysis in trading, and a trader should always focus on learning these candlestick patterns properly. Advanced traders also use candlestick patterns to forecast the market. Many candlestick patterns predict the bearish price trend, but you will learn to trade with the top 4 universal candlestick patterns in this article. These patterns apply to the candlestick chart of any market in the world like stocks, forex, cryptocurrency, etc. Moving in the other direction, just like bullish patterns needing bullish confirmation, bearish patterns require bearish confirmation. Bearish reversal patterns can also form with one or more candlesticks.

- The simplest method of confirming a hammer is to see whether the previous trend continues in the next session.

- Check this beautiful uptrend on the recent intraday chart of PLUG.

- This is a mammoth resource that contains virtually every candlestick formation you can trade in the forex markets.

- A harami cross is a candlestick pattern that consists of a large candlestick followed by a doji.

- Today, their full name, Japanese candlesticks, reflects that.

- This pattern is called the “piercing line” because the signal candle pierces the previous candle’s body by at least 50%.

This can lead to a sudden increase in buying pressure, resulting in the formation of the long bullish candlestick. Below we have collected all candlestick patterns that are found in forex. If price hits a support level and a bullish doji forms, you should be looking to buy the breakout of the high of that doji candlestick. But the second candlestick is shorter and lies withing the shadow of the first bearish candlestick.

Four Candlestick Patterns

But most traders call them candlesticks, or just candles, for short. Ensure that the pattern occurs at a significant level of resistance or a key price area, such as a previous swing high or a trend line. Check this beautiful uptrend on the recent intraday chart of PLUG. That is, until we get the Hanging Man, signaling the top for us. As you look at the chart, hopefully, you can pinpoint a great short entry as the last green candle is broken to the downside.

And after the formation of the pattern, the price has moved up even further. A bullish railroad track pattern, for instance, starts with a bearish candle and ends with a bullish. On the other hand, a bearish railroad track pattern starts with a bullish candle and ends with a bearish. Self-confessed Forex Geek spending my days researching and testing everything forex related.

Different variant patterns

Each one provides a trigger for your entry and allows you to set your maximum risk above the pattern. The three white soldiers pattern is a bullish reversal candlestick pattern that occurs at the end of a downtrend. It is a powerful pattern that consists of three large bullish candlesticks that appear when the bears are exhausted.

- The Doji candlestick pattern forms when the open and close of a candle is equal.

- One important economic factor to consider is interest rates.

- Sure, it is doable, but it requires special training and expertise.

- The doji or spinning top represents indecision in the market, and the subsequent red candle indicates that the bears have taken control.

These smaller candles, which are usually black, reflect the resistance of the trend and may suggest a potential trend reversal. The formation ends with another long white candle on the fifth candle, with an opening price higher than the closing price of the first candle. Bearish reversal candlestick patterns when they form, indicate that the trend may be changing from bullish to bearish.

Bearish Engulfing

Here I have explained the six bearish trend continuation candlestick patterns that are very important for forex and stock traders. The falling window is a bearish trend continuation pattern that consists of two bearish candlesticks with a gap between both candlesticks. The gap shows the imbalance area, which forms due to filling large pending sell orders.

The Falling Three Methods is a trend continuation pattern that signals a potential weakening of the current trend. However, as the market becomes overbought, some investors start to close their positions to take profits, leading to a wave of selling pressure that causes prices to drop. A gravestone doji is a type of candlestick pattern that appears on a chart for a stock or other asset. They may be taking profits from the recent downtrend and taking over orders from sellers who are exiting their positions.

Weekly Forex Forecast – Gold, EUR/USD, USD/JPY, AUD/USD – DailyForex.com

Weekly Forex Forecast – Gold, EUR/USD, USD/JPY, AUD/USD.

Posted: Sun, 15 Jan 2023 08:00:00 GMT [source]

On the other hand, a Gravestone Doji suggests a potential bearish trend. This is called a shooting star, and it’s another signal of a potential bullish reversal. The price action is the same as in an inverse hammer, with an early continuation of the rally being beaten back by sellers. Since this is occurring at the top of an uptrend, a reversal may follow.

Using Candlestick Charts for Trading

In an ideal Bullish Morning Doji Star formation, there is a gap both before and after the Doji candle, although this is not always the case. In reality, the three white soldiers pattern indicates that buyers are starting to enter the market and grow in strength. This suggests that the downward momentum in the market may be slowing and that buyers are starting to enter the market. If you see this pattern form in support levels as price hits them, you should be looking to buy. The first candlestick is bearish but the second one is bullish.

In case you were wondering, the names of candlestick patterns usually describe a visual representation to something in real life. Supplement your understanding of forex candlesticks with one of our free forex trading guides. Our experts have also put together a range of trading forecasts which cover major currencies, oil, gold and even equities. While these patterns and candle formations are prevalent throughout forex charts they also work with other markets, like equities and cryptocurrencies. The pattern is composed of a bearish candle that opens above but then closes below the midpoint of the prior bullish candle.

Top 10 Candlestick Patterns To Trade the Markets – DailyFX

Top 10 Candlestick Patterns To Trade the Markets.

Posted: Wed, 06 Feb 2019 08:00:00 GMT [source]

Like all technical analysis tools, the Bearish Morning Star pattern has its pros and cons and requires experience and skill to use effectively. Traders should use proper risk management and only trade with money they can afford to lose. The bearish engulfing candle is one of the forex market’s most clear-cut price action signals. Many traders will use this forex candlestick pattern to identify price reversals and continuations to support their trading strategies.

The Engulfing Pattern is a bullish pattern that suggests the trend may be reversing from bearish to bullish. In this blog post, we’ll take a closer look at all candlestick patterns and how you can use them to trade like a pro. If you see this candlestick pattern form in resistance level or where you’ve drawn a downward trendline, you should be looking to sell. Set your entry point above the close of the engulfing candlestick in case of a bullish outside bar pattern. If you’ve taken the first tip we’ve mentioned, that means you would be trading soon after the opening of the candlestick that follows the pattern. The bullish outside bar pattern appearing on a major uptrend suggest a trend continuation on the uptrend.

This indicator measures the strength of a currency pair’s price movement and can be used to identify potential overbought or oversold conditions. A high RSI suggests that the market is overbought and a potential reversal may occur, while a low RSI indicates that the market is oversold and a potential uptrend may occur. Like its bullish counterpart, a bearish harami is often taken as a signal of an impending downward move. If one arises during an existing downtrend, it indicates a continuation. The next red candlestick then opens above the close of its predecessor, before tumbling down beyond its mid-price.

They develop original trading strategies and teach traders how to use them intelligently in open webinars, and they consult one-on-one with traders. Education is conducted in all the languages that our traders speak. As long as the price creates a Bearish Harami pattern, open a SELL order right after that. However, they are most rewarding when you catch them just before the uptrend is reversed.

Weekly Forex Forecast – EUR/USD, S&P 500 Index, 2-Year … – DailyForex.com

Weekly Forex Forecast – EUR/USD, S&P 500 Index, 2-Year ….

Posted: Sun, 12 Feb 2023 08:00:00 GMT [source]

While there is a potential for profits there is also a risk of loss. Losses incurred in connection with trading stocks or futures contracts can be significant. Neither Americanbulls.com LLC, nor Candlesticker.com makes any claims whatsoever regarding past or future performance. All examples, charts, histories, tables, commentaries, or recommendations are for educational or informational purposes only. Today, I will introduce to you how to use the Bearish Harami candlestick pattern in Forex trading. This article will provide all the best knowledge about this special candlestick pattern.

This suggests that the market may be shifting in favour of the sellers. However, in the fourth session, there was a sudden increase in sellers, indicating that resistance has been found and that these sellers want to enter the market. It begins with a long white candle on the first day, followed by a horizontal line or Doji candle on the second candle, which creates a gap in the upward trend. The matching high is a two-candle pattern that indicates the end of an uptrend. This pattern indicates that the sellers have taken control of the market and are pushing the price down. On the third candle, the close must be above the close of the second candle in order to confirm the trend reversal.

Bearish three-bar play is a trend continuation candlestick pattern that also consists of two big red candlesticks with a base candle. This also draws the supply zone like drop base drop pattern in supply and demand trading. A bearish engulfing pattern occurs at the end of an uptrend.

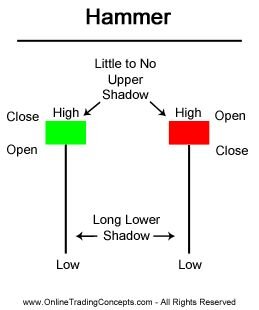

Say, for example, that you want to buy a rallying EUR/https://trading-market.org/, but you’re worried that it might retrace. A continuation pattern is a signal that the trend isn’t over yet. To find a hammer, look at the length of the body compared to the wick. The5%ers let you trade the company’s capital, You get to take 50% of the profit, we cover the losses.

In the EURUSD daily chart above, notice how the price was previously in a downtrend until the bullish outside bar candlestick pattern showed up. This is the point where the price makes a reversal that is going to last for the next few days. Similarly, when the bearish outside bar candlestick pattern shows up, the price reverses towards the downtrend. The reason this is a trap is that there are times when the price shoots up instantly, only to slump down just as rapidly within a short period of time. What we have in the end is a candlestick with a very long wick.

Additionally, false signals can occur, so risk management should be a key consideration in any trading strategy using this pattern. The Bearish Morning Star is a candlestick pattern in the world of forex trading. It is a three-candle formation that occurs at the end of an uptrend and signals a potential trend reversal to the downside.

Sometimes, the opening price of the bullish candlestick is lower than that of the previous bearish candlestick. In some other cases, the opening prices of the two candlesticks are at the same level. In the image on the right, we see a pull-back to the upside, followed by the formation of the bearish engulfing candlestick pattern. Two bearish candlesticks with a down gap show the strength of sellers, and closing bullish candle before the gap zone indicates the weakness of buyers. So, sellers are dominant here represents price will continue downtrend. The opposite is true for the bullish pattern, called the ‘rising three methods’ candlestick pattern.