Content

They even provide short-term loans to companies that require a little extra assistance paying bills or making payments. Best online loanhelps you reach a money goal, such as consolidating debt or covering a large expense, without creating financial stress. Interest rates and terms are typically based on your income and credit, and different lenders offer features that may be important to you, like payment flexibility or access to credit scores.

- Additionally, they need a steady income source that pays at least $800 a month.

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

- APRs are the only method to compare several loans to one another, so don’t be fooled by monthly interest rates that pass for yearly rates.

- An unlawful loan is a loan that fails to comply with lending laws, such as loans with illegally high interest rates or those that exceed size limits.

- If the turnaround time is important to you seek out a lender offering faster loans.

- She loves helping people learn about money and specializes in topics like fintech, investing, real estate, borrowing money and financial literacy.

It’s hard to get approved for a personal loan if you have a less-than-perfect credit score. Additionally, people with bad credit are often subject to a very high-interest rate resulting in a prohibitively expensive loan. Who among us are so carefree that they could not be bothered to pay the mounting bills for rent, health, car, emergencies or just daily expenses? But what if we’re not and on top of those bills we have a poor credit score? It’s great that our lending market has bad credit loan lenders ready to assist at any time.

How To Apply For A Payday Loan In 4 Steps

Even though you’re using your credit card, you won’t necessarily have the same interest rate on a cash advance as a normal purchase. You may begin accruing interest as soon as you withdraw the money — and you’ll likely face a processing fee. Getting a payday loan may be helpful if you’re in a pinch and don’t have savings or access to cheaper forms of credit.

What Should I Do Before I Get A Payday Loan Or A Cash Advance Loan?

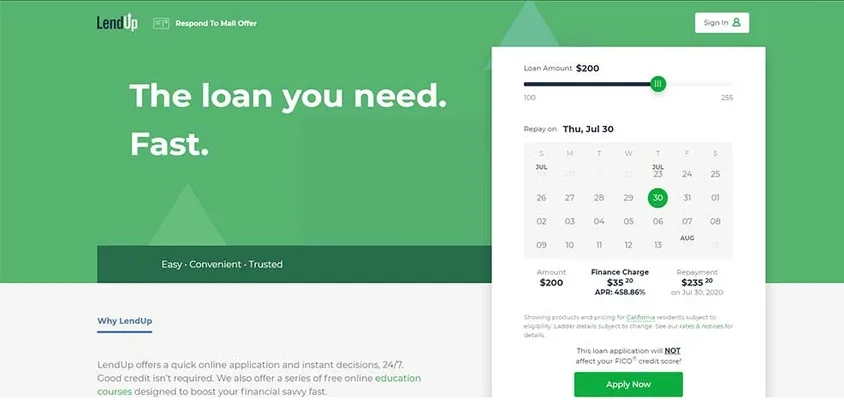

This can put SterlingCreditCards.com borrowers at a disadvantage and allows lenders to charge fees that lead to APRs of 700% or higher. To repay your loan, you will either need to provide your lender with access to your bank account for an automatic transfer or sign a post-dated check. Payday loans are small loans, usually under $1,000, meant for emergencies. Unlike other loans, lenders don’t require you to have good credit — and many won’t check your credit score with the big three credit bureaus.

By visiting the official website of the lender, you will be able to apply for instant cash. You will have to enter your personal and income details for loan processing. The lender might ask you to upload the proofs online for verification, following which your loan will be approved or rejected. The charges you might encounter with a payday advance app will vary depending on the app. Some apps charge a flat fee for each usage; others charge a monthly service fee. There are also apps that are free to use, but most of these encourage their users to leave tips to help the app continue running.

What Happens If I Cant Pay The Lender The Money I Owe?

Finally, this loan can improve your credit history if you are sure you will pay on time. Even though the word “car” is in the name, this loan is not just for auto repairs. It is just a payday loan, which has one significant difference – the need to provide collateral. Note that for a $300 loan, your credit score is not directly relevant unless you are taking an installment loan, so no Teletrack report is required.

Before applying for money from a bank, you should be aware of your income and debts. This will help you determine if your budget allows you to be up to date with the bank obligation you are going to acquire. In addition, you should analyze if it is necessary to resort to this option, since you can resort to other inputs such as severance payments, savings, etc.

List Of Top 25 Best Instant Loan Apps In Nigeria For 2022 And What They Are Best For!

You can secure a few hundred dollars in emergency cash, a short-term loan up to $10,000, or long-term installment loans worth up to $35,000 with our top-ranked payday loan marketplaces. If your credit score is under 600; you’ll be subjected to higher-than-average interest rates. While these rates can exceed 35.99% APR in some cases, most lenders won’t require such high interest. There is one caveat – if you have a bad credit score, you may not qualify for best-in-class interest rates, so it’s best to stick with bad credit loans instead. Although higher-than-average interest rates are part of the package, some loan terms are more forgiving than others. Our top-reviewed platforms can get you approved for $100 floats, $500 short-term loans, or $35,000 installment loans within minutes.